Photo: Kareem Michael, Governor, Central Bank of Belize

Central Bank reports full economic recovery from pandemic and reducing inflation

BELIZE CITY, Wed. Nov. 27, 2024

The Central Bank of Belize (CBB) is reporting a full recovery of Belize’s economy from the pandemic as well as falling inflation which had surged to 6.3% at its peak in 2022. At the CBB’s latest press conference to present updates on Belize’s economic landscape, Central Bank Governor, Kareem Michael remarked, “The Belizean economy has proved itself to be resilient.” He listed the COVID pandemic, the oil price shock due to the Russia-Ukraine war, and adverse shocks from climate-related events including Hurricane Lisa in 2022, as negative occurrences that Belize has weathered. “Today, we can confidently say that since the onset of the pandemic and these additional external shocks, our economy has fully recovered,” said Michael. In fact, he reported that the real Gross Domestic Product (GDP) per person in 2023 was at $15,500, well over the projected $13,500 if growth had continued on the path prior to the pandemic. Michael attributed the rebound in 2022 and 2023 primarily to the recovery of our tourism sector.

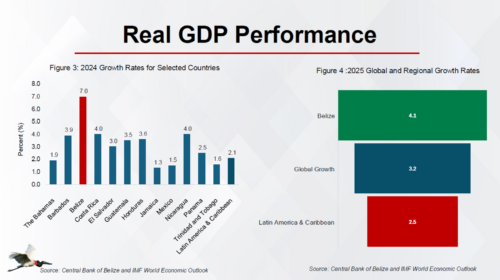

The Central Bank’s projection for Belize’s 2024 economic growth is a rate of 7%. This would be well above the IMF’s projected growth rate for Latin American and Caribbean countries, with the exception of Guyana, which is deemed an outlier due to its spectacular growth of over 40% linked to its recent oil discovery. For 2025, the projected growth rate for Belize is 4.1%, whereas the global average is expected to be around 3.2%.

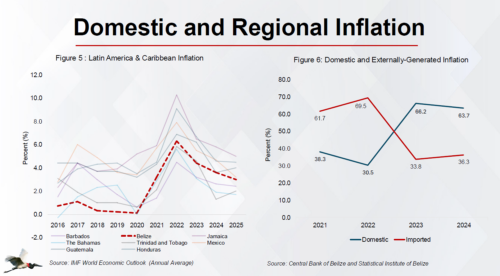

When it comes to inflation, Michael shared that upward pressures on prices have weakened, and inflation is “trending downward.” He did admit, though, that despite real GDP growth and the increased minimum wage “which helped to raise income, rising costs have partially offset these income gains.” As a result, said Michael, Belizean households have had to trade-off to stretch their dollar in meeting their expenses. In 2023, the inflation rate had dropped to 3.6%, which Michael attributes in part to the “unwinding of supply chain disruptions” seen earlier in the COVID-19 pandemic, as well as ease in the “energy and commodity price pressures” from the Russia-Ukraine war. According to the available figures, the Central Bank notes that, whereas inflation was externally driven in 2021 and 2022, in 2023 it was an increase in the prices of domestically produced food items that accounted for the lion’s share (44%) of inflation.

The projection for 2025 is a further reduction of inflation to 3%. Michael did concede that perhaps the Statistical Institute of Belize (SIB), from whom they draw the inflation figures, ought to expand the basket of goods and services used to determine its consumer price index, and perhaps include home prices and mortgage interest rates, which bite off a huge chunk of the disposable income of families. The Governor also cautioned that the impacts of climate-related events can also further drive up inflation.

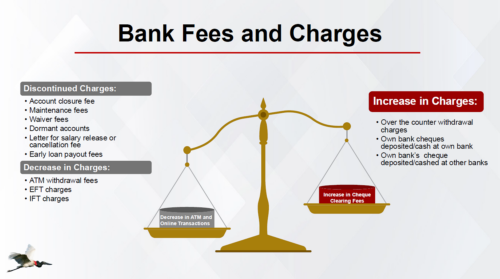

Domestic banks retaliated against the CBB’s attempt to drive down fees

Today, Central Bank Governor Kareem Michael explained that the bank tried to do its part in assisting consumers through lowered transactional costs in the banking sector. “I’m sure the media is well familiar with this battle,” said Michael in reference to the negotiations that ensued when the Central Bank attempted to introduce Practice Direction 7 in 2023. In the subsequent negotiations that followed after a legal challenge was initiated by the commercial banks, it was agreed that all ATM fees would be capped at 25 cents, and there would be reduced fees for early pay-out of residential mortgages, among others. Michael agreed with the interpretation that the banks collectively retaliated by hiking fees for over-the-counter withdrawals and check clearings. When Amandala asked if the CBB has done an assessment to determine if the new fee changes imposed by the banks outweigh the benefits that resulted from its efforts to drive down banking fees, Michael responded, “The increases on this side should be less than the overall activity within the financial system, so, the way how online transactions have been growing — and growing exponentially — versus how many people still actually want to go into a bank and wait in line to do over the counter. And also, I think it is slowly sinking in within those people who are still using cheques that it is not the way to go. There are better ways to conduct financial transactions.”

Room for improvement regarding interest spreads

During his remarks at today’s Central Bank press conference, Governor Michael also noted that there is room for improvement when it comes to the interest spreads for money lending, as well as the rate that commercial banks pay for deposits. He pointed out that there has been little change in this regard for more than 10 years. Imposing changes, however, would be challenging, according to Michael, who says that it is a reality faced by the banking sector in many small countries “that have similar market structures and macro environments that induce wider interest rate spreads.” He added, “In our case, I think the situation is compounded by the fact that our system is so small, having just four domestic commercial banks accounting for the lion’s share of the financial sector.”

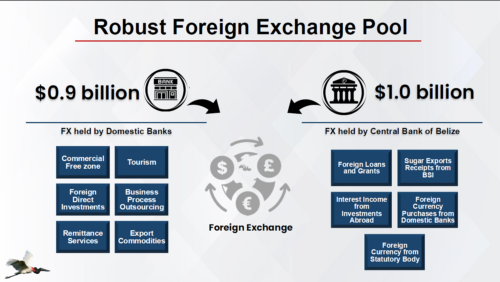

CBB reports robust foreign exchange reserves

Another piece of good news shared by the Central Bank today was that its foreign exchange reserves remain robust, with 4 months of import cover or 1 billion dollars held by the Central Bank and another $0.9 million held collectively by the domestic banks. Michael remarked that this is the highest our foreign exchange pool has ever been. Tourism, again, leads the charge with revenue from that sector up 11.6% or $1.2 billion from January to September this year.

In the case of Foreign Direct Investment (FDI), Michael informed that it is “very strong” for the first three quarters of the year at 44% or $195.4 million. Remittances are at $222.3 million, while our export revenue is listed at $783.3 million and business process outsourcing at $169.1 million. Loan disbursements account for $149.4 million.

Debt to GDP ratio still listed as 64% despite new loans

Belize’s finance experts in Government, like Minister of State Chris Coye and Financial Secretary Joseph Waight, reported previously that from as far back as 2022, our debt-to-GDP ratio had gone down to 64%. Debt-to-GDP ratio, as per a definition by Investopedia, is a metric which compares a country’s public debt to its GDP, and reliably indicates a country’s ability to repay its debts by comparing what it owes with what it produces.

With the signing of the Blue Bond in November 2021, our debt-to+GDP ratio was reduced by 12% from a sky-high 133% to about 121%. When the Statistical Institute of Belize implemented rebasing (updating the methodology used to estimate GDP) in the first half of 2022, Belize’s rate was reduced to a percentage in the 80’s range. Thereafter, we were told that, with the agreement of the Venezuelan government to shave off between BZ$257 million and $327 million from our PetroCaribe debt, our public debt had gone down to 64.1% in 2022. The international standard for sustainability is 60%. But almost two years later, our authorities are still citing the same figure for our debt-to-GDP ratio, despite new loans having been approved by the National Assembly.

Our question to Central Bank Governor Kareem Michael today, when he reported the 64% figure at the Central Bank press conference, was why the debt-to-GDP ratio has remained the same despite the new external debt. Among them has been the BZ$90 million Saudi loan for the University Hospital (June 2023) and BZ$14 million from the Inter-American Development Bank for fisheries (October 2023), among many others. Michael explained that, with the rebasing exercise, the denominator (GDP) was increased by 27%, plus about 4 years of good growth. That resulted in the denominator becoming bigger in comparison with the numerator (the debt). In that regard, Michael also pointed out that due to fiscal discipline there has been amortization (repayment of loans) that has reduced the debt.